Strong US labour market puts the Fed under pressure

- 24 March 2023

- Posted by: Federica Montella

- Categories: eToro CopyTrader, Investing

Wall Street went up yesterday

Thursday has been a positive day for the US stock market.

All three major US indexes closed in profit.

The S&P 500 finished at +0.30%, the Nasdaq ended the trading session at +1.01% and the Dow Jones closed at +0.23%.

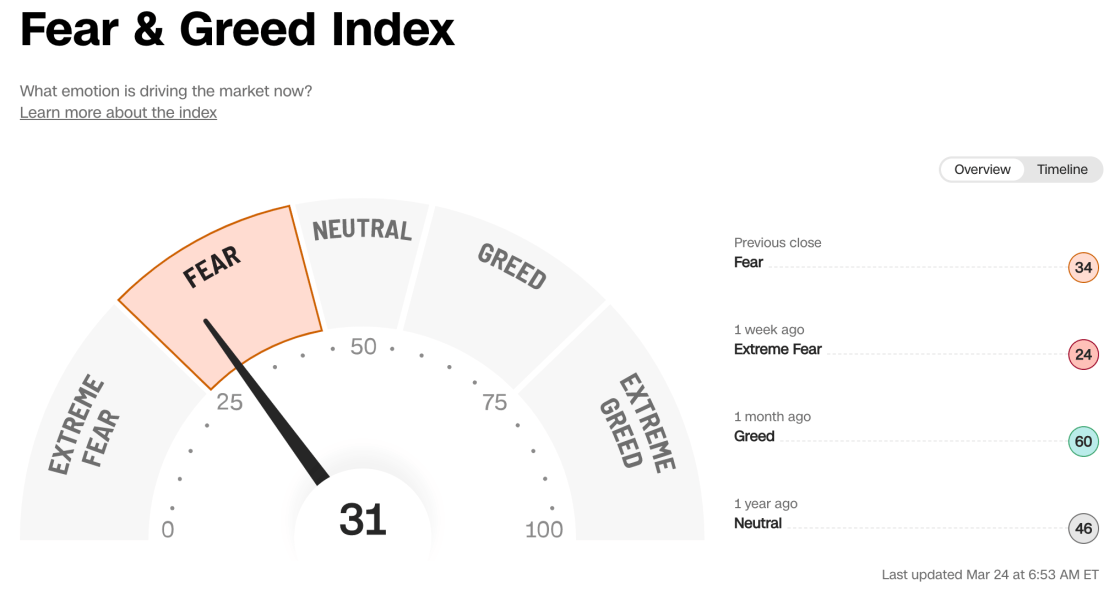

The investors’ sentiment is Fear, as indicated in the graph below:

Sentiment indicator – Fear & Greed Index

The market sentiment is 31, in “Fear” mode, up from last week’s data in Extreme Fear.

Actions will be taken to protect the financial system

Yesterday, US Treasury secretary Janet Yellen said that regulators will be “prepared to take additional actions if warranted” to reassure that the banking system and depositors are safe.

The reassurance comes after Yellen’s comment where she said “We are not considering insuring all uninsured bank deposits.” on Wednesday,

Unfortunately, the latest Yellen speech has not been sufficient enough to prevent the selloff of the KBW bank index and the shares of First Republic that have lost 6.2%.

Labor Market Remains Strong

The weekly Initial jobless claims have been released, yesterday by the Labour Department.

The latest report has shown that 192,000 new people have filled out the unemployment benefit claim, which is 6,000 units less than the economists forecast.

Based on the latest data we can affirm that the labour market remains particularly strong despite some big companies having recently announced layoffs.

This week Amazon announced its plan to eliminate 9,000 jobs and Indeed to cut 15% of its employees. Meta has already shared its plan to fire almost 10,000 people from its workforce.

For the Federal Reserve and its mission to bring down inflation, having a labour market so robust is a problem, because people continue to spend their money fuelling inflation.

Portfolio update

I remain neutral and cautious about the stock market.

I hold long and short stock positions and aim to profit regardless of the market direction.

If you are already copying my portfolio, please keep the copy open.

If you are thinking of copying me, now could be the right time, if you can invest for the long term (years).

Remember to copy the open trades to optimize the copy.

Remember to set the stop loss on the copy at the minimum level, so you don’t get stopped if there is a correction.

Thank you, everyone. Have a nice day!

Steps to follow to copy my portfolio automatically:

1. Create an eToro account here: https://federicamontella.com/go/etoro/

2. Verify your account and make a deposit of at least 200 USD (you can deposit in any currency, like GBP and EUR)

3. Go to my profile page: https://federicamontella.com/go/etoro-passionforprofit/

4. Start the copy (copy open trades and set the lowest stop loss possible, to allow some movement)

5. Enjoy, it’s all automatic. You will make passive income 24/7

Let me know if you have any questions.

Federica Montella

eToro Popular Investor